Examination on Accounts and Audit Functions

-Dr.

Lalit Kumar Setia

The examinations of Accounts Officers, on Financial and Compliance Audit, Methods and Procedure of Auditing including auditing in Information Technology (IT) environment are very easy to attempt after going through the material available on my webpages. The Auditing standards are issued by Comptroller Auditor General in India, at the international level, these are issued by IFAC and INTOSAI.

The

CPD test and syllabus focuses on the understanding of the Audit function. In

Government, the Accounts Officer is Head of an office of Accounts responsible

to ensure effective utilization of financial resources and compliance of rules

in the department. The Audit officer is the head of an office of Audit. The

Audit Officer and Accounts Officer, both are inter-related. An accounts officer

performs functions as per financial rules while an audit officer checks and

points out the irregularities while performing financial functions with

recommendations to do the same work better.

To

know the responsibilities of a Head of Accounts Office, the following article

is a must-read.

https://drlalitsetia.blogspot.com/2021/08/responsibilities-of-head-of-accounting.html

From where do the funds/grants come in a

Government office?

Article

267(1) of the constitution establishes Contingency Fund and an officer is

designated as ‘Drawing Officer’ by the Central Government or Head of the

Department; for drawing bills from this fund so that the financial functions may

be discharged as per Government Accounting Rules 1990, Government Account

(Receipt and Payment) Rules, 1983 and the orders or instructions issued latest

in this regard.

How

Haryana Treasuries are performing financial functions with the help of

allotting Unique Code of Payee. Have a detailed reading of the following –

https://drlalitsetia.blogspot.com/2021/09/how-does-unique-code-of-payee-work.html

It

is well known that an audit is an examination of accounting records which includes

entries of financial transactions undertaken for performing the official duties

by the officers of an office.

The PC-8 paper of Financial Rules and

Principles of Government Accounts:

The

Group II examinations for Subordinate Audit/Accounts Services (SAS) are

particularly related to Financial Rules, Principles of Accounting in

Government, Audit function, etc. The examination books are available on the web

portal of CAG and the syllabus is also prescribed by the CAG, the sole

authority entrusted with the responsibility of audit of accounts.

It

is required to have a detailed understanding of Financial Procedures in

Government, also explained in the following article –

https://managerialadministration.blogspot.com/2018/04/financial-procedures-in-government.html

Can an Executive Force Audit Officer modify audit findings?

This

question is generally asked by the participants, Auditors in my class whether

the Audit should be independent or not? It is interesting to clear that an

Auditor General of State and Comptroller Auditor General in Central Government,

is fully independent and there is no power in the hands of executive to direct

the Audit Officers to modify or refrain from carrying out a fair audit, derive

conclusions, and recommend to ensure proper utilization of the financial

resources.

How

the rules enforce the financial control and how the administration is held responsible

if any irregularity stays for the long term –

https://managerialadministration.blogspot.com/2018/10/accounts-administration-and-prevention.html

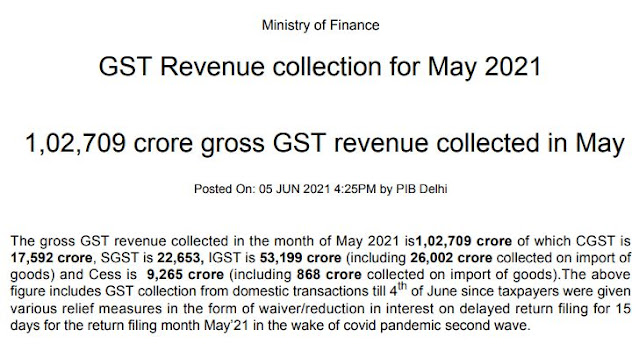

Financial Audit

To

verify whether the Government Accounts are properly prepared or not, whether

the applicable laws and rules are compliance or not, whether there is a need to

point out excess or shortfall in expenditure or not, and if there are any

irregularities, what should be an action plan for sorting out the issues and

timely completion and monitoring of the financial statements?

How

to ensure effective financial administration –

https://managerialadministration.blogspot.com/2018/10/effective-financial-administration.html

*Copyright © 2021 Dr. Lalit Kumar. All rights reserved.

This article is written by Dr. Lalit Kumar Setia; a renowned author and trainer. He completed his Doctorate in Commerce from Kurukshetra University Kurukshetra and MBA in Information Technology from GJU, Hisar. He also wrote two books, 15 research papers, and organized more than 200 Training Courses during his working period since 2006 in Haryana Institute of Public Administration, Gurugram. The article was published on 8th October 2021 and last updated on 8th October 2021. The writer can be contacted on lalitkumarsetia@gmail.com