Haryana Budget 2021-22 : An Overview

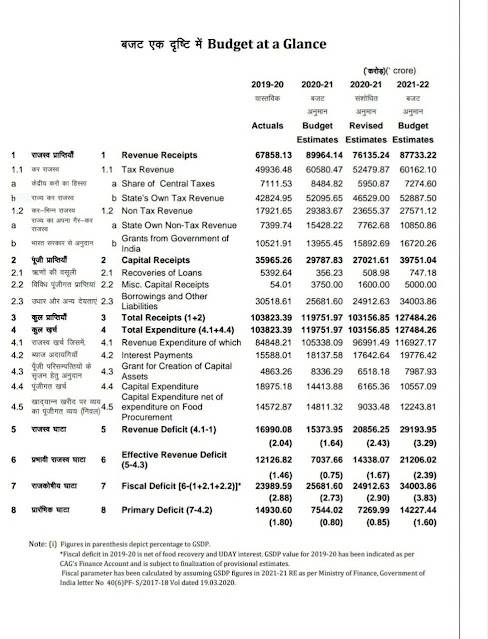

The Chief Minister of Haryana presented Budget today on 12th March, 2021. He proposed Budget for Rs. 1.55 Lac Crores; which is almost 13% more than the budgey of last Financial Year 2020-21.

Out of total Expenditure, 25% is related to Capital Expenditure while 75% is related to Revenue Expenditure. The Capital Expenditure is for Rs. 38,718 Crores and the Revenue Expenditure is for approximate Rs. 1.17 Lac Crores.

Last year, the revenue deficit was Rs. 20,856 Crores and in next year, it is estimated that the revenue deficit will be Rs. 29,193 Crores. The increase is revenue deficit states that there will be more expenditure on items not related to long term development of the state.

In case, more amount is allocated for development or capital expenditure, in long-run the capacity to earn revenues is increased which also support the Government to finance its revenue expenditure. The revenue deficit is estimated at 3.29% of Gross State Domestic Product (GSDP).

The Fiscal Deficit which is 2.9% during the year 2020-21 is estimated to be increased up to 3.83% of Gross State Domestic Product. However, the 15th Finance Commission stated to maintain the Fiscal Deficit up to 4% and the budget is also maintaining the same.

In order to finance the revenue deficit, the debt liability is also estimated to be increased from 1.99 Lac Crores to Rs. 2.29 Lac Crores and it is estimated to be 25% of Gross State Domestic Product (GSDP).

The Old Age Pension will be increased from Rs. 2250 to Rs. 2500 per month from 1st April, 2021. The Budget Outlay is increased from Rs. 5052 Crores to Rs. 6110 Crores and out of Rs. 6110 crores of Budget Outlay, Rs. 2998 Crores is earmarked for Agriculture and Farmers Welfare, Rs. 1274 for Cooperation, Rs. 1225 Crores for Animal Husbandry, Rs. 489 Crores for Horticulture, and Rs. 125 Crores for Fisheries.

The Budget Outlay shows that the overall focus is to support farmers through Agriculture, Cooperation, Animal Husbandry, Horticulture, and Fisheries. The amount will be spent upon schemes of Agriculture, Crop Diversification through Horticulture, Water Conservation Schemes, and promoting Fisheries.

Last year, the Health Sector has been allocated Rs. 6433 Crores and this year, an expenditure of Rs. 7731 Crores is earmarked for Health Sector.

Further, the Government has also allocated Rs. 700 Crores for promoting Technology driven learning with use of digital infrastructure in Government Schools. However, earlier EDUSAT was used and remained unsuccessful. Now it is a new challenge for School Education Department to apply it and for this the School Principals, Lecturers and Teachers require training specifically in implementing Digital Education as per National Education Policy of India.

The Government of Haryana will also provide Rs. 114.52 Crores for financial assistance to girl students. The Parivar Pehchan Patra - PPP Family IDs will be used to identify poorest families and financial assistance will be provided for uplift-ment to such beneficiaries through a new scheme i.e. The Mukhyamantri Antyodya Parivar Utthan Abhiyan - MAPUA; an amount of Rs. 1,80,000 will be used during the Financial Year 2021-22 on various measures for these poorest families including support in Education, Skills Development, Wages and Self Employment, and Job Creation etc. The objective of the Abhiyan is to uplift the families above the line of Poverty.

No comments:

Post a Comment

Happy to hear from you. Please give your comments...