Compliance of 206AB for DDOs

-Dr. Lalit Kumar Setia

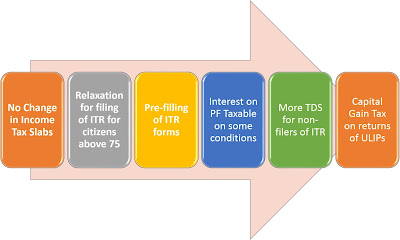

In

the Union Budget 2021, a new rule was introduced to deduct Tax Deduction at

Source (TDS) at higher rates on cases with certain nature of income and from

the persons who have not filed Income Tax Return (ITR) in the last two years

and total amount TDS exceeds Rs. 50,000 in each year. How to know, whether the

person whose TDS is being deducted is the person with requirement to deduct TDS

rates at higher rate or not? What will be the rate of TDS if it is required to

deduct at higher rate? How to ensure compliance of Section 206AB which is

having this rule?

How much TDS be deducted if person

lies in certain category to deduct TDS on Higher Rate?

As

per provisions, the TDS will be either “twice the rate of TDS normally deducted

as specified in a particular relevant section” or 5% whichever is higher. It

means the TDS rate will be at least 5% for such persons and higher than 5% if

twice rate of TDS is more than 5%.

How to know that the person whose TDS

to be deducted, has not filed ITR during last two years and total TDS amount

exceeds Rs. 50,000 in each year?

The

Deductors (DDOs in Government) required to ensure compliance of 206AB &

206CCA which states to deduct TDS at higher rates for certain category of

persons. How to know whether the person whose TDS is being deducted falls in

such category or not.

The

Income Tax Department web-portal has a functionality to check such persons by

inserting their PAN number or PAN Numbers in bulk. The deductors (if required)

can feed PAN number of the person and get the response from the web-portal,

download the response in .pdf file, and thereafter keep the same or show the

same to the person and deduct TDS at higher rates. For the Financial year

2021-22, from 1st July 2021, it is enforced to implement section

206AB and 206CCA.

The

persons who did not file Income Tax Returns (ITRs) of FY 2018-19 and FY 2019-20

and have aggregate of TDS amount Rs. 50,000 or more in each of the previous

years; will be listed in that functionality. The Income Tax Department will

list such persons every year and according to the list, the Deductors will have

to deduct TDS at higher rate for such persons whose name is listed in the

functionality.

As

per notification no. 1 of 2021-Income Tax dated 22.06.2021:

Compliance Check Functionality for

Section 206AB & 206CCA of Income-tax Act 1961

Section 206AB and 206CCA inserted in the Income-tax Act,1961

(effective from 1st July 2021), imposed higher TDS/TCS rate on the “Specified

Persons’ defined as under,

“For the purposes of this section ‘

specified person” means a person who has not

filed the retums of income for both of the two assessment years relevant to the

two previous years immediately prior to the previous year in which tax is

required to be collected, for which the time limit of filing retum of income under sub-section (1) of section 139 has expired; and the

aggregate of tax deducted at source and tax collected at source in his case is

rupees fifty thousand or more in each of these two previous years.

Provided that the specified person shall

not include a non-resident who does not have a permanent establishment in India.

Explanation.-For the purposes of this sub-section,

the expression ‘permanent establishment” includes a fixed

place of business through which the business of the enterprise is wholly or

partly carried on.”

2. To facilitate Tax Deductors and Collectors in

identification of Specified Persons as defined in sections 206AB and 206CCA,

the Central Board of Direct Taxes (“CBDT”), in exercise of powers conferred

under section 138(1 )(a)(i) of Income-tax Act, 1961 (Act), has issued Order via F.No. 225/67/2021/ITA.II

dated 21.06.2021 , directing that Director General of

Income-tax (Systems), New Delhi shall be the specified income-tax authority for

furnishing information to the “Tax Deductor/Tax Collector”, having registered

in the reporting portal of the Project Insight through valid TAN, to identify

the ‘Specified Persons’ for the purposes of section 206AB and 206CCA of the Act

through the functionality “Compliance Check for Section 206AB& 206CCA”.

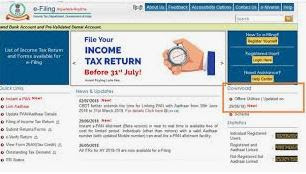

3. Income Tax Department has released a new functionality

·Compliance Check for Section 206AB & 206CCA to facilitate tax

deductors/collectors to verify if a person is a “Specified Person” as per

section 206AB & 206CCA. This functionality is made available through

(https://report.insight.gov.in) of Income-tax Department. Kindly refer to CBDT Circular No. 11 of 2021 dated

21.06.2021 regarding use of functionality under section

206AB and 206CCA of the Income-tax Act, 1961 .

4. The following procedure is laid down for sharing of

information with tax deductors/collectors:

a) Registration: Tax Deductors and Collectors

can register on the Reporting Portal by logging in to e-filing portal

(http://www.incometax.gov.in/) using e-filing login credential of TAN and

clicking on the link “Reporting Portal” which is available under “Pending

Actions” Tab of the e-filing Portal. After being redirected to the Reporting

Portal, the tax deductor/collector needs to select Compliance Check (Tax

Deductor & Collector) under Form Type. The details of the principal officer

also need to be provided by clicking on “Add Principal Officer” button. The

principal officer is the authorized person of the tax deductor/collector to use

the Compliance Check functionality on reporting portal. After submission of

registration request, email notification will be shared with the Principal

Officer along with ITDREIN details and login credentials.

b) Accessing the Compliance Check functionality:

Principal

Officers of the entities (Tax Deductors & Collectors) which are registered

with the Reporting Portal through TAN shall be able to use the functionality

after login into the Reporting Portal using their credentials. After

successfully logging in, link to the functionality “Compliance Check for

Section 206AB & 206CCA” will appear on the home page of the Reporting

Portal.

c) Using “PAN Search” mode:

Under

the “Compliance Check for Section 206AB & 206CCA” page, “PAN Search” tab

may be selected to access the functionality in PAN Search mode. In this mode

single valid PAN along with captcha can be entered at a time and output will be

available with following fields,

o

Financial Year: Current Financial Year

o

PAN: As provided in the input.

o

Name: Masked name of the Person

(as per PAN).

o

PAN Allotment date: Date

of allotment of PAN.

o

PAN-Aadhaar Link Status: Status

of PAN-Aadhaar linking for individual PAN holders as on date. The response

options are Linked (PAN and Aadhaar are linked), Not Linked (PAN & Aadhaar

are not linked), Exempt (PAN is exempted from PAN-Aadhaar linking requirements

as per Department of Revenue Notification No. 37/2017 dated 11th May 2017) or

Not-Applicable (PAN belongs to non-individual person).

o

Specified Person u/s 206AB & 206CCA: The

response options are Yes (PAN is

a specified person as per section 206AB/206CCA as on date) or No (PAN is not a

specified person as per section 206AB/206CCA as on date).

Output will also provide the date on which the

“Specified Person” status as per section 206AB and 206CCA is determined.

d) Using “Bulk Search” mode:

Under

the “Compliance Check for Section 206AB & 206CCA” functionality page, “Bulk

Search” tab may be access to access the functionality in Bulk Search mode. This

mode involves following steps:

i. Preparing request (Input) file containing PANs: Under

the “Bulk Search” page, CSV Template to enter PANs details may be downloaded by

clicking on “Download CSV template” button. PANs for which “Specified Person”

status is required may be entered in the downloaded CSV template. The current

limit in the number of PANs in a single file is 10,000.

ii. Uploading the input CSV file: Input

CSV file may be uploaded by clicking on Upload CSV button. Uploaded file will

start reflecting with Uploaded status.

iii. Downloading the output CSV file: After

processing, CSV file containing “Specified Person” status as per section 20SAB

& 206CCA of the entered PANs will be available for download and “Status’

will change to Available. Output CSV file will contain PAN, Masked Name,

Specified Person Status as per section 20SAS & 206CCA, PAN-Aadhar Link

status and other details as mentioned in paragraph c) above. After downloading

of the file, the status will change to Downloaded. The download link will

expire and status will change to Expired after specified time (presently 24

hours of availability of the file).

5. For any further assistance, Tax Deductors &

Collectors can refer to Quick Reference Guide on Compliance Check for Section

206AS & 206CCA and Frequently Asked Questions (FAQ) available under

“Resources’ section of Reporting Portal. They can also navigate to the “Help”

section of Reporting Portal for submitting query or to get a call back from

Customer Care Team of Income-tax Department. Customer Care Team of Income-tax

Department can also be reached by calling on its Toll Free number 1800 1034215

for any assistance.

6. This issues with the approval of CBDT. (Sanjeev Singh), ADG(Systems)-2 CBDT.

On which categories of income,

Section 206AB is not applicable?

The

Drawing and Disbursing Officers (DDOs) in Government organizations and

employers in Private Sector Organizations; generally deduct TDS on Salaries of

the employees u/s 192 of Income Tax Act. The new section 206AB is not

applicable on such TDS deduction. Further, it is also not applicable on TDS

deducted on withdrawl from Provident Funds u/s 192A, Winnings from Lotteries /

races on which TDS is deducted u/s 194B & 194BB, Payment of certain amount

on which TDS is deducted u/s 194N, and Income in respect of investment in

securitisation trust on which TDS is deducted u/s 194LBC.

Section

206AB and Section 206CCA will be applicable on the persons whose time limit for

filing ITR under section 139(1) has expired and the person has not filed ITR

during last 2 previous years and also whose aggregate TDS in each of these previous

years is Rs. 50,000 or more.

Are you interested in an Online Course related to Income Tax?:

1. https://smartinstituterls.blogspot.com/2022/12/income-tax-matters-in-government.html

2. https://smartinstituterls.blogspot.com/2022/12/computation-of-income-tax-liability.html

Previous Article

Next Article