Details

for e-filing Income Tax Return

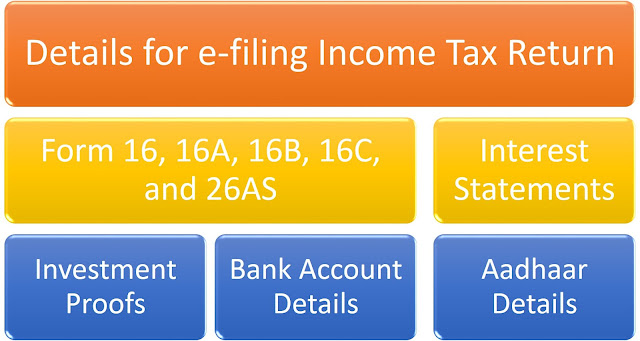

The Income Tax Return (ITR) is mandatory to be e-filed by every person

whose Gross Total Income is more than his Basic Exemption Limit i.e. Rs.

2,50,000 for Individuals who are not senior citizens, Rs. 3,00,000 for senior

citizens, and Rs. 5,00,000 for super senior citizens. The individuals before e-filing

the Income Tax Return should prepare details and keep in hand so that no

problem appears while filling the desired Income Tax Return Form. What

documents should be realized for preparing the details of incomes. Why to

provide complete details and how to be assured that every financial earning has

been detailed as required by Income Tax Department:

(i) Form 16 from Employers:

The salaried individuals

should receive Form 16 from their respective employers as it is a proof of the

Tax Deducted at Source by the employer and the details provided in Form 16

should be kept in hand so that the same details are filled in Income Tax Return

Form under the head ‘Salaries’.

(ii) Form 16A from Deductors other than Employers:

In case, the tax is

deducted by others than the employer/s then Form 16A should be realized from

them. Generally, banks and post office deduct tax at source on ‘Interest on

Deposits’; in such cases, Form 16A should be taken from them and kept in hand

while e-filing Income Tax Return.

(iii) Form 16B from the Buyers:

Sometimes, properties are

sold during the financial year and buyers deduct Tax Deduction at Source from

the amount to be paid by them. In such case, the buyer deposits such TDS to

Income Tax Department and generate Form 16B. Therefore, in such cases, Form 16B

should be taken from the Buyers (if any).

(iv) Form 16C from Tenants:

In case, an individual is

getting rent form the tenants and it is more than Rs. 50000 per month; in such

cases, the tenants are directed to deduct Tax Deduction at Source from the

payment of rent to the individual (landlord). Then the tenants deposit the TDS

in Income Tax Department and realized Form 16C to be provided to the landlord.

Such Form 16C should also be realized and kept in hand while e-filing Income

Tax Return.

(v) Tax Credit Statement 26AS / Annual Information Statement - AIS from website of Income Tax:

Apart from Form 16, 16A,16B,

and 16C from the Deductors, an individual should also download Tax Credit Statement 26AS / Annual Information System - AIS, from

the website of Income Tax Department and match the details of deductions at

source with the Tax Credit Statement before e-filing Income Tax Return. In case of

mis-match, it should be decided which details are accurate and accordingly the

return should be filed. In case, there is any mismatch, the individual should

ask the deductor to rectify the mistake and e-file rectified TDS statement so

that accurate amount be reflected in Tax Credit Statement / Annual Information Statement. In case, the mismatch is not

corrected, then the individual will receive a notice from the Income Tax

Department for clarification of mismatch.

(vi) Statement of interest on Deposits:

The amount of interest

earned on deposits in Post Office, Banks, and other Financial Institutions

should be prepared from the Statement of Interest taken from them.

(vii) Collection of proofs to claim Deductions:

There are a lot of

deductions available to be claimed under section 80C to 80U for the individuals

and there are a lot of exemption available under section 10 which may be taken

into consideration while quantifying the taxable portion of incomes earned

during the financial year. An individual should keep all the records relating to claimed exemptions, deductions in separate file as the proofs may be asked

by the Income Tax Officers at any time in future.

Generally, tax savings

are claimed for investments under section 80C, 80CCC, 80CCD (1) limited upto an

amount of Rs. 1,50,000 and additional benefit for NPS investment of Rs. 50000 in

80CCD(1B); and for expenditures under other sections i.e. 80D to 80U. In 80D,

the proof of receipt for payment of Health Insurance Premium for self, spouse

and/or children and in 80E, proof for payment of interest on education loan

should be maintained. How to claim 80G deduction for contribution in Haryana Chief Minister Relief Fund:

For deduction in 80G, the details of organization come under 80G with name, PAN number, location etc; should be prepared and kept in hand.

(viii) Home Loan Statement with Interest Charged:

In case of home loan

taken from Bank or Non-Banking Financial Companies; the statement of home loan

principal amount as well as interest amount charged during the year should be

taken. The amount of principal amount is counted in 80C for deduction purposes

and ‘interest on home loan’ is claimed under the head ‘income from house

properties’ under section 24. The maximum amount for self-occupied property for

interest is Rs. 2,00,000.

(ix) Income on sale of Capital Asset:

The individuals who sold

any capital asset during the financial year, should compute income or loss on

the sale of Capital Asset. The details of buyer with PAN number should also be

available at the time of e-filing Income Tax Return. In case of sale of mutual

funds, equity shares, such details can be taken from the broker.

(x) Details of Bank Accounts:

Before e-filing Income

Tax Return, an individual should prepare the list of active bank accounts and

it is also required to pre-validate the bank accounts so that the refund (if

any) can easily come in the pre-validated bank account. For pre-validation, it

is necessary to link the bank account with PAN which is usually linked. For

each bank account, the details i.e. Bank Name, Account Number, IFSC Code and

type of Bank Account should be ready.

(xi) Aadhaar Details:

An individual should keep

the Aadhaar details ready while e-filing Income Tax Return. It is mandatory now

to quote Aadhaar number in Income Tax Return; even for e-verification, a

message come on Aadhaar linked mobile number for verification of the Income Tax

Return at the end of e-filing Income Tax Return.

New portal for e-filing Income Tax Return:

The old portal of

incometaxindiaefiling.gov.in has been replaced with new portal incometax.gov.in

from FY 2020-21. The ITR forms have also been changed. The process is also

changed. What are the major changes, let’s understand in simple words. Firstly,

JSON utility is introduced for offline filing of Income Tax Return (ITR) for

the convenience of the taxpayers. Secondly, the old return preparation software

is replaced with more interactive return preparation software in new online tax

payment system, integrated for immediate processing of ITR.

What happens if a taxpayer withdraws amount

exceeding a specified limit:

From FY 2020-21, as

per the Budget 2020 speech, a new section was introduced i.e. 194N. The

taxpayers who have not filed ITR for last three years and withdraw cash in

excess of Rs. 20 Lacs, have to pay 2% TDS. For normal taxpayers the limit is

Rs. 1 Crore from FY 2019-20, from one bank / post office account. In case, the

amount is withdrawn above the limit, 2% TDS is deducted.

Such persons under

Income Tax Act, will not be eligible to file ITR-1 and such TDS will also not

be carried forward to next year if it is not claimed as refund during the

current year.

Tax on Dividend Income in the hands of Recipient:

The Dividend

Distribution Tax (DDT) has been abolished from FY 2020-21. If a taxpayer

received Dividend from company, it will be taxable in the hands of taxpayers.

Tax Deducted at Source for the payments to

Resident Contractors and Professionals:

The contractors with

turnover / receipts exceeding Rs. 1 crore and the professionals with turnover /

receipts exceeding Rs. 50 Lacs require to get their books audited. The

deductors for the taxpayers with audited books, are required to deduct TDS under

section 194C and 194J respectively.

In case, the TDS

is not deducted u/s 194C and 194J then the TDS at the rate of 5% will be deducted

u/s 194M.

In case TDS is

deducted u/s 194M, the deductors have to issue Form 16D to the payees /

deductees within 15 days of the due date of furnishing the challan-cum-statement

in Form 26QD.

Conclusion:

It is mandatory to file the return on time with correct particulars. Suppose a person is working in an organisation and his source of income is Salary. Similarly a person is working in private sector as a professional. The major source of income will be Salary in first case and Business or profession in second case. For Salaried persons, TDS is deducted by employers and on the basis of TDS a certificate is issued known as Form 16. For other source of income, the Deductors other than employers, issue a certificate known as Form 16A. After getting such certificates, download the 26AS or Annual Information Statement from login of income tax. How much money was received from the employers, how much TDS deducted, and how much taxes already paid either by person or on behalf of person, each information is gathered and written on plain paper. All these things are filled in the return. Keep in mind that the information usually provided by a person in ITR should match with Form-16 / Form 16A. Otherwise the notice comes from the income tax department.

Last updated - July 29, 2021

*Copyright © 2019 Dr. Lalit Kumar. All rights

reserved.