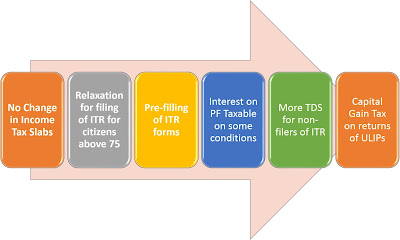

In last article, we learned how Fuel Taxation is being used to increase the collection of tax to meet the fiscal deficit. In the Financial Budget 2021, the income tax rates are not increased and the Government projects to have collection from disinvestment, GST, and Fuel Taxation.

No Change in Income Tax Slabs:

The rates

of income tax are same as earlier in both old tax regime and new tax regime. No

changes are made.

Relaxation for filing of ITR for senior citizens above

age of 75:

The senior

citizens who are above the age of 75 and receiving income only from pension and

interest as a source of income, will not require to file income tax return.

However, for such relaxation it is the condition that their interest income

should be from the same bank in which the amount of pension is deposited. It is

worth to mention here that in such circumstances; the bank will deduct the tax

deduction at source (TDS) as per the taxable liability of the senior citizen

after keeping in mind the deductions u/s 80C to 80U and rebate of 87A. It means

the filing of ITR will not be required because the tax liability already be

deducted at TDS by the bank.

Pre-filling of ITR forms:

Like

earlier, the 26AS tax credit statement data automatically pre-filled by the

web-portal of income tax india efiling dot gov dot in. From April 1, 2021; the

details of dividend, interest, and capital gains will be pre-filled so that the

same cannot be concealed by the taxpayers. Similarly, the details of salary

incomes, tax payments, TDS etc. will also be pre-filled on the basis of the

information available with the income tax department. It is worth to mention

here that the deductors including employers, banks, financial institutions etc.

normally communicated the amount of TDS to the income tax department on monthly

and quarterly basis; the same will be considered to pre-fill the information.

Interest on part of PF contributions which are

exceeding Rs. 2.5 Lacs in a year; will be taxable:

From 1st

April, 2021 if there is interest income earned on the portion of PF contributions

which are exceeding Rs. 2.5 Lacs in a year; will be taxable in the hands of recipients.

This provision is applicable on all the three PF contributions including GPF,

EPF, and PPF. Due to this provision, the high income citizens would like to

make investments in NPS instead of PF after the amount be invested up to Rs.

2.5 Lacs in their PF accounts. (How Money Grows in NPS)

No TDS on dividend payments to Real Estate Investment

Trusts (REIT) and Infrastructure Investment Trusts (InvITs):

From the

year 2020-21, the dividend distribution tax was abolished and the dividend

income was made taxable in the hands of shareholders. From the year 2021-22,

the dividend payments to REIT and InvITs will be exempt from TDS.

Incorporating Section 206AB for charging TDS on higher

rate from the Non-filers of ITR:

The

citizens who are still not filing income tax return (ITR), are required to pay

more TDS on their incomes. The higher rate of TDS will be either 5% or twice

the rate specified in the relevant provision of the Act. This is done to

encourage citizens to file the income tax return (ITR).

Capital Gains Tax on returns of Unit Linked Insurance

Plans (ULIPs):

The ULIPs

issued on or after 01.02.2021 in which an individual is paying annual premium

above Rs. 2.5 Lacs will be subject on Capital Gain Tax at the time of

redemption.

Reduction in Last date for filing delayed ITR:

Up to 31st March, 2021; the

last date for filing delayed ITR was 31st March, on voluntarily

basis; means the return of the FY 2019-20 can be filed up to 31st

March 2021 if delayed. But from FY 2021-22, the last date of filing delayed ITR

will be 31st December, on voluntary basis; means the return of FY

2020-21 can be filed up to 31st December 2021 instead of 31st

March 2022. It is worth to mention here that u/s 234F, if an individual is

filing ITR after the due date but before 31st December; then maximum

penalty is Rs. 5000 (Five Thousands). In case, anyone wants to revise the filed

ITR, then it can be revised up to the end of Assessment Year.

How to know Income Tax Refund Status:

Now, it is very easy to view the income

tax refund status, just login with your PAN Number and password on the website

of incometax dot gov dot in and go to "My Account". Click

the command "Refund/Demand Status". The portal will display the status

with mode of payment by which it has been credited in your account.

It is worth to mention here that the

income tax refund comes within 20 - 45 days after processing of the income tax

return (ITR) by Centralized Processing Centre (CPC), however, it is delayed in

few circumstances:

If any query is raised by the Income

Tax Department and the reply to that query took times from your side. In such

cases, the refund is withheld by Income Tax Department for assessment and to

clarify any mismatch between the details submitted by taxpayer and the details

already available with the Income Tax Department.

What can be done for getting delayed Income Tax Refund?

First of all, check your registered

email whether there is any query pending from the Income Tax Department or not.

If there is any query, then respond as per the directions provided in the

email.

In case, no such email is available,

then check dashboard after logging into the account on incometax dot gov dot in.

In case, the bank account details

submitted by the taxpayer during filing ITR are wrong, then also the income tax

refund is delayed. In such case, the taxpayer can update the banking details,

to get the refund at the earliest.

The income tax refund status can also

be checked upon the website of NSDL.

*Copyright © 2021 Dr. Lalit Kumar.