Arrears of Dearness Allowance to Government Employees

What are Arrears?

Whenever a person delivers services,

he becomes entitled for remuneration for the services. In case of employees

working in an organization, the remuneration in form of salaries paid after the

end of a period (usually a month). The amount accrued from the date on which

the first missed payment was due.

When Arrears are paid to Government Employees:

The employees get a salary hike or

Dearness Allowance hike from the months which have been passed, but the amount

is not received. Such amount is computed and paid as arrears to the Government

employees. For example, the Dearness Allowance raised from 17% to 28% from 1st

July 2021 and paid in the month of August with the salaries of July, then there

will be no arrears.

But the increase in Dearness

Allowance from 17% to 28%, was due from a long period of Covid-19 pandemic. 4%

increase was pending from January to June 2020 and 3% was pending from July to

December 2020. Further, 4% was pending from Jan to June 2021. It means 4%+4%+3%

= 11% was pending to be provided to the Government employees due to compensate

them as increase in Dearness Allowance in response to rise in the inflation.

Arrears for Dearness Allowance from 17% to 28% from July 2021:

In India, the Central Government and

most of the State Governments have decided to freeze the Dearness Allowance

(DA) of Government employees due to financial hardship in result of Covid-19

pandemic in India and the States. The Government of Haryana had already decided

to not provide arrears of DA due from July 2020 to January 2021 (https://www.livemint.com/news/india/haryana-govt-freezes-dearness-allowance-at-current-rate-till-july-2021-11594105517856.html).

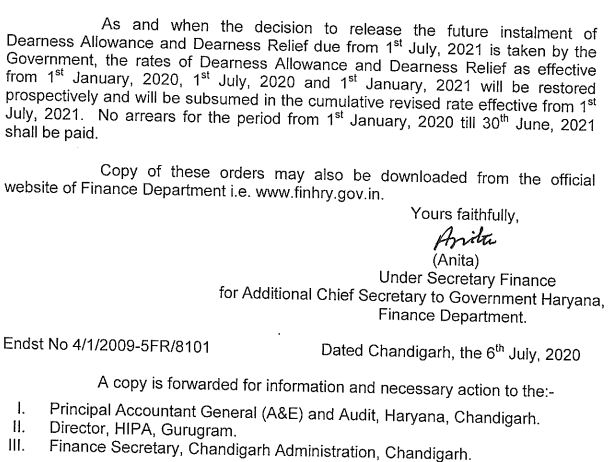

The Government had decided to restore

the rate of Dearness Allowance prospectively and revised rate be effective from

July 2021 with the remarks that no arrears for the period from Jan 2020 to June

2021 be provided. The letter of Finance Department, Government of Haryana dated

6th July 2020 stated that additional instalment of Dearness

Allowance payable to Haryana Government Employees due from 1st Jan

2020 shall not be paid.

The letter is available at http://www.finhry.gov.in/FileUploads/Upload_7826f176-33d2-4a20-8514-2c7f82a19035_.PDF

Whether Government may decide to give Dearness Allowance Arrears or not?

As per the decision, the Government

has decided that the arrears of Dearness Allowance shall not be paid. It

happened due to financial hardship which come from the pandemic of Covid-19. In

case, Government decides to give arrears, there will be huge cash outflow from

the treasuries of Government.

Fall in GST collections due to Covid-19 Pandemic:

It is well known that the major

source of revenue collection of Government in India and States, is now Goods

and Services Tax (GST). In the month of June 2021, the collections of GST is

Rs. 92,849 Crores. http://gstcouncil.gov.in/sites/default/files/gst-statistics/GST-Revenue-Collection-June-2021.pdf

The collection in GST was decreased

as the Government provided relief measures in form of waiver or reduction in

the interest on delayed return filing for 15 days for the return filing month

June 2021 for the taxpayers with the aggregate turnover up to Rs. 5 Crore in

the wake of covid pandemic second wave.

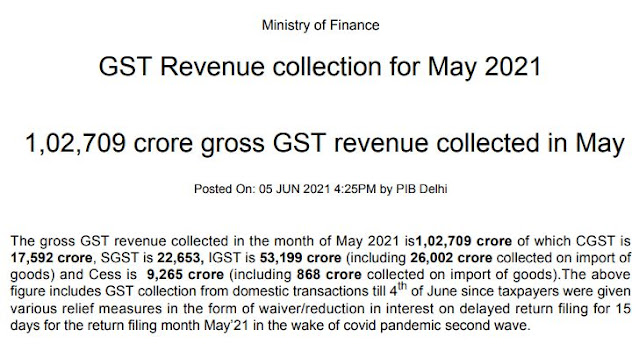

In May 2021, the GST collection was

Rs. 1,02,709 Crores. In May 2021, the taxpayers had been given various relief

measures in the wake of covid pandemic second wave.

In April 2021, despite of second wave

of Covid-19 pandemic, the Indian businesses have paid the GST and filed the GST

returns on time and the GST Collection was Rs. 1,41,384 Crores.

In March 2021, the GST Collection was

Rs. 1,23,902 Crores. However, during this month the Central Government has

settled the amount of IGST in the ratio of Fifty Fifty with the States and UTs.

In February 2021, the GST collection

was Rs. 1,13,143 Crores. In this month also, the Central Government settled the

amount of IGST with the States / UTs in ratio of Fifty Fifty.

In Jan 2021, the GST collection was Rs. 1,19,847 Crores. Keeping in view the collections from Jan 2021 to June 2021; the Government decided to settle the complications from fall in the collection of GST and reduce the revenue expenditure.